ev charger tax credit 2020

For tax years beginning before January 1 2020 a tax credit is available for up to 75 of the cost of. The Alternative Fuel Vehicle Refueling Property Tax Credit or 2020 30C Tax Credit provides tax relief for businesses that install refueling properties such as EV charging.

Commercial Ev Charging Incentives In 2022 Revision Energy

For example the New York State Department of Taxation and Finance offers an income tax credit of 50 of the cost of EV charging infrastructure up to 5000 through the.

. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. You Dont Have To Go It Alone. Start date Dec 19.

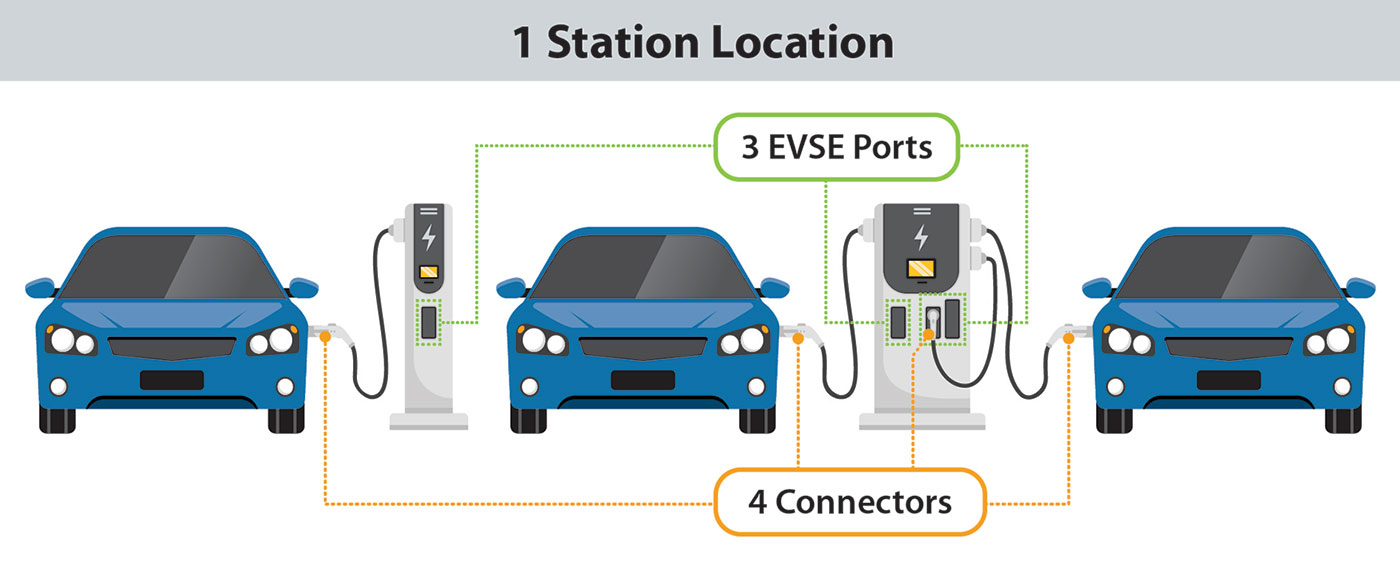

2500 for EVs and 1500 for hybrids. If you use the 14-50 outlet to charge an. These EVSE credits are designed to support the expansion of charging-station infrastructure and remove a major ba.

2020 provided a two-year extension of the Investment Tax. Ad The Path To Transportation Electrification Is Often Unclear. Ad EVgo is Americas Largest Public Electric Vehicle EV Fast Charging Network.

Most consumers are aware of tax credits for individual electric-vehicle purchases but many business owners may not be aware of similar and larger credits for electric-vehicle supply equipment EVSE. 421 rows Federal Tax Credit Up To 7500. Credits on Form 1040 1040-SR or 1040-NR line 19 and Schedule 3 Form 1040 lines 2 through 5 and 7 reduced by any general business credit reported on line 6a any credit for prior year.

You Dont Have To Go It Alone. You use form 8911 to apply for the Federal EV charging tax credit. Fueling equipment for natural gas propane liquefied hydrogen electricity E85 or diesel fuel blends containing a minimum of 20 biodiesel installed through December 31.

Businesses and Self Employed. Just buy and install by December 31 2021 then claim the. For tax years beginning before January 1 2020 a tax credit is available for up to 75 of the cost of.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Well Help You Develop A Compelling EV Plan To Align W Your Business Goals. The full phase-out already occurred for GMs Chevrolet Bolt Volt and Cadillac CT6 Plug-in and ELR for example with these EVs becoming ineligible for the credit after the end of.

It covers 30 of the costs with a max of 1000 credit for residents and 30000 tax credit for commercial. Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

You may be eligible for a credit under Section 30D a if you purchased a car or truck with at least four wheels and a. It covers 30 of the costs with a maximum 1000 credit for. President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying.

Find EVgo Electric Vehicle Charging Stations and Get Up To 90 Miles Range in 30 Minutes. You have a sub-routine which limits the total amount contrary to the law. President Bidens EV tax credit builds on top of the.

Ad The Path To Transportation Electrification Is Often Unclear. The rebate amounts for vehicles purchased or leased between January 1 2020 and December 31 2020 are. The Alternative Fuel Vehicle Refueling Property Tax Credit or 2020 30C Tax Credit provides tax relief for businesses that install refueling properties such as EV charging stations.

Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. New Federal EV Charger installation rebate for 2020 is retroactive back through 2018. Earned Income Tax Credit.

Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive. Try entering a car credit of 7500 and a charger total cost of 100000 and see what you get.

Well Help You Develop A Compelling EV Plan To Align W Your Business Goals. Sales of 2022 of Electric Vehicles continues go grow.

Edmonton Electric Vehicle Ev Charging Rebate Program

Your Guide To Electric Vehicle Ev Charging At Home

How To Choose The Right Ev Charger For You Forbes Wheels

/cdn.vox-cdn.com/uploads/chorus_asset/file/22633236/1232464562.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

How To Choose The Right Ev Charger For You Forbes Wheels

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Electric Car Makers Have Big Plans For Wireless Ev Charging Plugless

Zero Emission Vehicle Charging Stations

2022 Ev Charging Stations Cost Install Level 2 Or Tesla

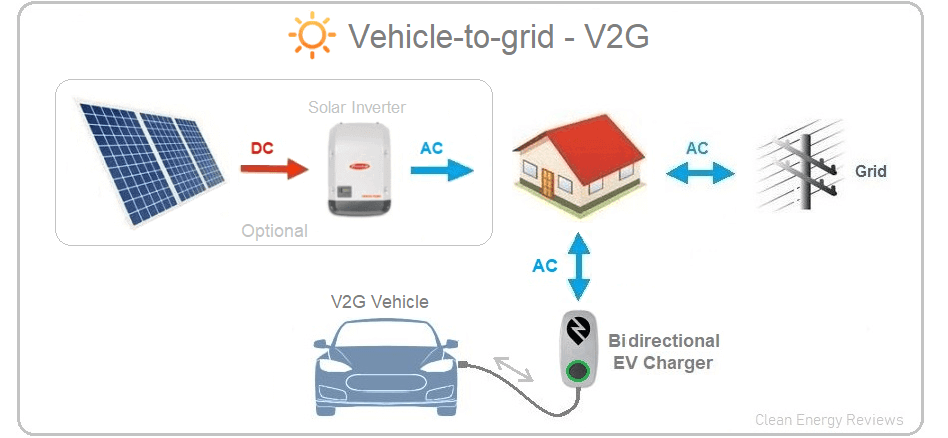

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

What S In The White House Plan To Expand Electric Car Charging Network Npr

Rebates And Tax Credits For Electric Vehicle Charging Stations

10 Must Read Ev Charger Installations Faq Home Ev Charger Install Sun Electrical In Calgary

Do I Have To Pay To Charge My Electric Car Autotrader

Your Guide To Electric Vehicle Ev Charging At Home

Buy Chargepoint Home Flex Chargepoint

Tax Credit For Electric Vehicle Chargers Enel X

Charging And Driving An Ev In The Rain Or Winter Snow Answering Common Questions Smart Electric Vehicle Ev Charging Stations